Disclosures

Basel III Pillar 3 Disclosures

Introduction

The Basel III Framework of the Basel Committee on Banking Supervision as implemented by the Office of the Superintendent of Financial Institutions (“OSFI”) requires Legacy Private Trust (the “Company”) to make certain disclosures so that market participants can assess its capital adequacy.

The Basel III Framework of the Basel Committee on Banking Supervision as implemented by the Office of the Superintendent of Financial Institutions (“OSFI”) requires Legacy Private Trust (the “Company”) to make certain disclosures so that market participants can assess its capital adequacy.

Capital Structure

The Company’s Common Equity Tier 1 and Total Tier 1 regulatory capital are published by OSFI and are available at the link below. The Company does not have Tier 2 or Tier 3 capital.

http://www.osfi-bsif.gc.ca/Eng/wt-ow/Pages/FINDAT-tc.aspx

The Company’s Common Equity Tier 1 and Total Tier 1 regulatory capital are published by OSFI and are available at the link below. The Company does not have Tier 2 or Tier 3 capital.

http://www.osfi-bsif.gc.ca/Eng/wt-ow/Pages/FINDAT-tc.aspx

Risk Exposure and Assessment

Risk Management Framework (“RMF”)

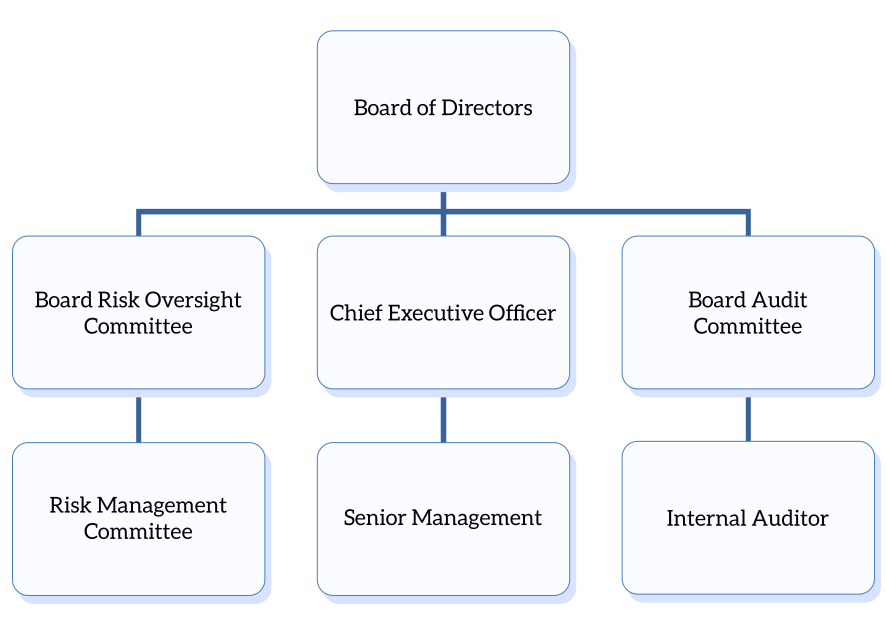

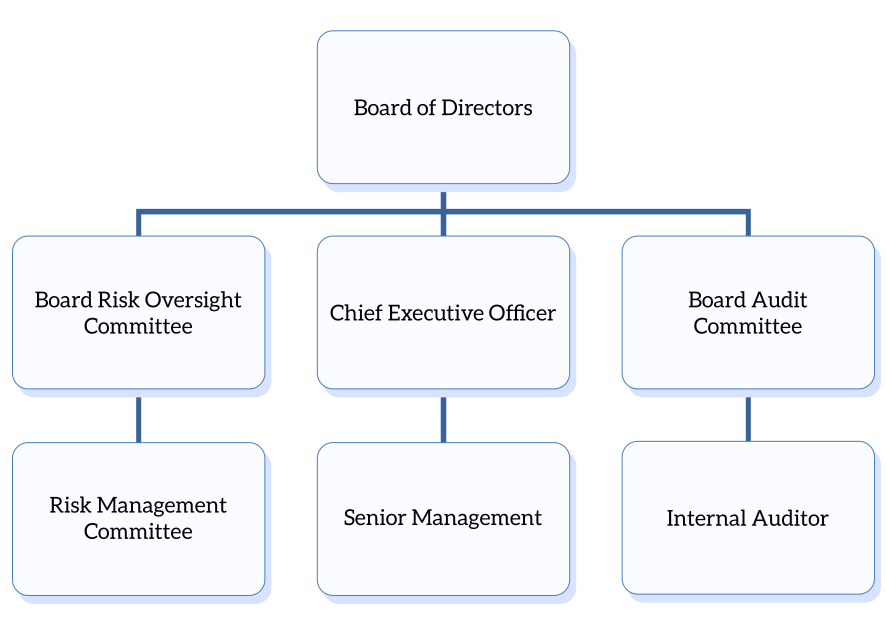

The objective of the RMF is to safeguard the Company’s capital, property and interests and the interests of its directors, officers and employees during the conduct of Company operations. The Board of Directors, Senior Management and all employees are involved in the on-going review of risks to the Company’s business operations.

The Board of Directors (the “Board”)

The Board has the ultimate responsibility for the implementation, review and approval of the RMF.

The Board Risk Oversight Committee

The Board Risk Oversight Committee assists the Board in fulfilling its stewardship responsibilities regarding the RMF. The Committee’s specific duties include reviewing and approving the RMF and the Company’s risk appetite and guiding for the governance of the Company’s existing and emerging risk taking activities.

The Audit Committee

The Audit Committee assists the Board in fulfilling its stewardship responsibilities regarding financial matters and internal controls. The Committee is responsible for oversight of the quality and integrity of the Company’s accounting and reporting practices and the performance of the internal auditor and the external auditors.

The Risk Management Committee

The Risk Management Committee is a committee of management charged with assessing and managing risks to which the Company is subject. Members of this committee are responsible for reporting to the Board Risk Oversight Committee on any issues, and associated risks, considered to be material.

Senior Management

Senior Management is responsible for pursuing suitable business opportunities within the approved risk limits and managing risks within each member’s respective areas. Senior Management also ensures that policies, processes and internal controls are in place and any significant risk issues are escalated appropriately.

Internal Auditor

The Internal Auditor continually reviews the RMF to ensure that effective and adequate controls are in place to mitigate risk to acceptable levels. Internal Audit results are reported directly to the Audit Committee.

Stress Testing

The Company’s Stress Testing Program is an integral part of the RMF. It is used to assist the Company to mitigate risks and develop contingency plans and risk management practices. It is also used to guide the Company’s higher-level decision making and for risk identification and control. It supports the Company’s management of its capital and liquidity.

The objective of the RMF is to safeguard the Company’s capital, property and interests and the interests of its directors, officers and employees during the conduct of Company operations. The Board of Directors, Senior Management and all employees are involved in the on-going review of risks to the Company’s business operations.

The Board has the ultimate responsibility for the implementation, review and approval of the RMF.

The Board Risk Oversight Committee assists the Board in fulfilling its stewardship responsibilities regarding the RMF. The Committee’s specific duties include reviewing and approving the RMF and the Company’s risk appetite and guiding for the governance of the Company’s existing and emerging risk taking activities.

The Audit Committee assists the Board in fulfilling its stewardship responsibilities regarding financial matters and internal controls. The Committee is responsible for oversight of the quality and integrity of the Company’s accounting and reporting practices and the performance of the internal auditor and the external auditors.

The Risk Management Committee is a committee of management charged with assessing and managing risks to which the Company is subject. Members of this committee are responsible for reporting to the Board Risk Oversight Committee on any issues, and associated risks, considered to be material.

Senior Management is responsible for pursuing suitable business opportunities within the approved risk limits and managing risks within each member’s respective areas. Senior Management also ensures that policies, processes and internal controls are in place and any significant risk issues are escalated appropriately.

The Internal Auditor continually reviews the RMF to ensure that effective and adequate controls are in place to mitigate risk to acceptable levels. Internal Audit results are reported directly to the Audit Committee.

The Company’s Stress Testing Program is an integral part of the RMF. It is used to assist the Company to mitigate risks and develop contingency plans and risk management practices. It is also used to guide the Company’s higher-level decision making and for risk identification and control. It supports the Company’s management of its capital and liquidity.

Internal Assessment of Capital Adequacy (“ICCAP”)

The Company’s approach to capital adequacy and management is driven by strategic and organizational requirements. The ICAAP assesses the adequacy of capital and reflects the fact that the Company is small, focuses on fiduciary services and, although deposit-taking, does not issue loans and mortgages. Senior Management analyzes and assesses the risks identified through the ICAAP and designs and implements risk prevention, reduction and avoidance measures. The Board has the ultimate responsibility for approval, oversight, review and testing of the ICAAP. The Board is also responsible for setting the Company’s tolerance for risk, assessing the framework developed by Senior Management for assessing various risks and establishing a method for monitoring compliance with internal policies. These duties have been delegated to the Board Risk Oversight Committee which meets quarterly.

The Company’s approach to capital adequacy and management is driven by strategic and organizational requirements. The ICAAP assesses the adequacy of capital and reflects the fact that the Company is small, focuses on fiduciary services and, although deposit-taking, does not issue loans and mortgages. Senior Management analyzes and assesses the risks identified through the ICAAP and designs and implements risk prevention, reduction and avoidance measures. The Board has the ultimate responsibility for approval, oversight, review and testing of the ICAAP. The Board is also responsible for setting the Company’s tolerance for risk, assessing the framework developed by Senior Management for assessing various risks and establishing a method for monitoring compliance with internal policies. These duties have been delegated to the Board Risk Oversight Committee which meets quarterly.

Material Risks Assessed

Market Risk

The Company incurs market risk in its trading activities. The Company complies with Section 451 of the Trust and Loan Companies Act (the “Act”) by not acquiring control of, or holding, acquiring, or increasing a substantial investment in any entity other than those described in s.453 of the Act. The Company complies with s.465 of the Act by investing its corporate funds only in marketable securities listed on a recognized stock exchange, funds established by the Company that invest only in such marketable securities or instruments of, or guaranteed by, the Government of Canada, the United States, a province or a state.

In accordance with s.450 of the Act, the primary objective of the investment of corporate funds is capital preservation. No more than 15% of regulatory capital is held in participating shares of any single entity, with the exception of bonds and treasury bills guaranteed by the Government of Canada and units of common funds of the Company. The Chief Investment Officer has primary responsibility for selecting investments and tables a detailed listing of the investments of the Company at each quarterly meeting of the Investments and Lending Committee.

Operational Risk

The Company incurs operational risk in all its business activities. The capital charge for operational risk is determined using the basic indicator approach within the Basel II framework. Operational risk can never be fully eliminated, but it is adequately managed through the Company’s RMF. The RMF identifies, reduces and eliminates risks to the Company and provides adequate and timely compensation, restoration and recovery.

The Board, Senior Management and all employees are involved in the development of the RMF and on-going reviews of risks to the Company’s operations. The Board has the ultimate responsibility for implementation, review and approval of the RMF. The Board Risk Oversight Committee is charged with assessing and managing risks to which the Company is subject. The Company’s Internal Auditor continually reviews the RMF to ensure effective and adequate controls are in place to mitigate risks to acceptable levels. Internal Audit results are reported quarterly to the Audit Committee and the Board.

Reputational Risk

The Company’s reputation is one of its most valuable assets and the safeguarding of it is the responsibility of all directors, officers and employees. Senior Management and the Board consider significant potential reputational risks to the Company and manage them using policies, the code of conduct and the RMF.

Legal and Compliance Risk

The Company has a strict policy of compliance with all statutory and other laws to which it and its business are subject. A comprehensive Regulatory Compliance Management System has been established to ensure regulatory compliance by the Company. It includes tools to manage compliance with federal and provincial laws, and regulations. The Chief Executive Officer and the Chief Compliance Officer report regularly to the Board that identification, assessment, communication and maintenance of applicable regulatory requirements are in full compliance with all laws and regulations. All employees confirm adherence to the Company’s code of conduct and anti-money laundering and anti-terrorist financing policy on an annual basis.

The Company incurs market risk in its trading activities. The Company complies with Section 451 of the Trust and Loan Companies Act (the “Act”) by not acquiring control of, or holding, acquiring, or increasing a substantial investment in any entity other than those described in s.453 of the Act. The Company complies with s.465 of the Act by investing its corporate funds only in marketable securities listed on a recognized stock exchange, funds established by the Company that invest only in such marketable securities or instruments of, or guaranteed by, the Government of Canada, the United States, a province or a state.

In accordance with s.450 of the Act, the primary objective of the investment of corporate funds is capital preservation. No more than 15% of regulatory capital is held in participating shares of any single entity, with the exception of bonds and treasury bills guaranteed by the Government of Canada and units of common funds of the Company. The Chief Investment Officer has primary responsibility for selecting investments and tables a detailed listing of the investments of the Company at each quarterly meeting of the Investments and Lending Committee.

The Company incurs operational risk in all its business activities. The capital charge for operational risk is determined using the basic indicator approach within the Basel II framework. Operational risk can never be fully eliminated, but it is adequately managed through the Company’s RMF. The RMF identifies, reduces and eliminates risks to the Company and provides adequate and timely compensation, restoration and recovery.

The Board, Senior Management and all employees are involved in the development of the RMF and on-going reviews of risks to the Company’s operations. The Board has the ultimate responsibility for implementation, review and approval of the RMF. The Board Risk Oversight Committee is charged with assessing and managing risks to which the Company is subject. The Company’s Internal Auditor continually reviews the RMF to ensure effective and adequate controls are in place to mitigate risks to acceptable levels. Internal Audit results are reported quarterly to the Audit Committee and the Board.

The Company’s reputation is one of its most valuable assets and the safeguarding of it is the responsibility of all directors, officers and employees. Senior Management and the Board consider significant potential reputational risks to the Company and manage them using policies, the code of conduct and the RMF.

The Company has a strict policy of compliance with all statutory and other laws to which it and its business are subject. A comprehensive Regulatory Compliance Management System has been established to ensure regulatory compliance by the Company. It includes tools to manage compliance with federal and provincial laws, and regulations. The Chief Executive Officer and the Chief Compliance Officer report regularly to the Board that identification, assessment, communication and maintenance of applicable regulatory requirements are in full compliance with all laws and regulations. All employees confirm adherence to the Company’s code of conduct and anti-money laundering and anti-terrorist financing policy on an annual basis.

Pillar 3 Remuneration Disclosures

Qualitative Disclosures

Overseeing Remuneration

Main Body Overseeing Remuneration: Name, Composition and Mandate

The Board Risk Oversight Committee is the main body overseeing employee remuneration and is composed entirely of independent directors. The Committee Members are:

D. Ross Kerr (Chair)

James Love

Ross Whalen

Overseeing Remuneration

The Board Risk Oversight Committee is the main body overseeing employee remuneration and is composed entirely of independent directors. The Committee Members are:

D. Ross Kerr (Chair)

James Love

Ross Whalen

The mandate of the Risk Oversight Committee regarding remuneration is:

External Consultants

Due to the Company’s small size and specific business lines, no external consultant advice has been sought in regards to remuneration.

Scope of Remuneration Policy

The Human Resources and Compensation Policy (the “Policy”) has a broad scope. The Board of Directors and the Risk Oversight Committee focus on long-term profitability based on a comprehensive business strategy. Compensation structures are designed to reward sustained employee performance over multiple years rather than short term performance. The Policy is designed to effectively balance risk management with sound business decisions and link compensation to employee performance.

The Company has one business location; it does not have branches or foreign subsidiaries.

Material Risk Takers

Material risk takers are the Business Development Group and the New Business Committee. Senior Management includes the Chief Executive Officer, Chief Financial Officer/ Chief Investment Officer, Vice President, Legal/ Chief Risk Officer and Vice President, Operations.

- To determine and review on an annual basis the Human Resources and Compensation Policy of the Company and present it to the Board of Directors for approval;

- In determining such Policy, assess all factors and risks which it deems necessary to ensure fair compensation;

- To determine the methods of assessing performance-related remuneration and the eligibility of senior management to receive bonuses and benefits;

- To consider any other matters relating to the remuneration of the members of senior management; and

- To ensure that remuneration of risk and compliance employees are considered independently of the business lines they oversee.

Due to the Company’s small size and specific business lines, no external consultant advice has been sought in regards to remuneration.

The Human Resources and Compensation Policy (the “Policy”) has a broad scope. The Board of Directors and the Risk Oversight Committee focus on long-term profitability based on a comprehensive business strategy. Compensation structures are designed to reward sustained employee performance over multiple years rather than short term performance. The Policy is designed to effectively balance risk management with sound business decisions and link compensation to employee performance.

The Company has one business location; it does not have branches or foreign subsidiaries.

Material risk takers are the Business Development Group and the New Business Committee. Senior Management includes the Chief Executive Officer, Chief Financial Officer/ Chief Investment Officer, Vice President, Legal/ Chief Risk Officer and Vice President, Operations.

Design & Structure of the Remuneration Process

Key Features and Objectives of Remuneration Policy

The Company’s Policy is designed to attract and retain competent staff with the appropriate knowledge, skills and experience. The Policy is designed to maintain a balanced approach to compensation and contribute to the achievement of the Company’s short and long term goals. Due to the Company’s small size and specific business lines, compensation practices are simplified and of low risk. Incentive and market-driven compensation are not part of current employment contracts. Variable compensation is granted at management’s discretion and is risk adjusted, if necessary.

Review of the Remuneration Policy by the Management Risk Management Committee in 2021

The Policy was reviewed by the Management Risk Management Committee on August 5, 2021. The Policy was reviewed and approved by the Board Risk Oversight Committee and the Board of Directors on August 25, 2021.

Risk and Compliance Employees

All risk and compliance employees receive compensation that reflects industry standards, their responsibility and their contribution to the Company. Compensation is determined by individual performance and contribution to their respective department, not the financial performance of the Company.

The Company’s Policy is designed to attract and retain competent staff with the appropriate knowledge, skills and experience. The Policy is designed to maintain a balanced approach to compensation and contribute to the achievement of the Company’s short and long term goals. Due to the Company’s small size and specific business lines, compensation practices are simplified and of low risk. Incentive and market-driven compensation are not part of current employment contracts. Variable compensation is granted at management’s discretion and is risk adjusted, if necessary.

The Policy was reviewed by the Management Risk Management Committee on August 5, 2021. The Policy was reviewed and approved by the Board Risk Oversight Committee and the Board of Directors on August 25, 2021.

All risk and compliance employees receive compensation that reflects industry standards, their responsibility and their contribution to the Company. Compensation is determined by individual performance and contribution to their respective department, not the financial performance of the Company.

How Current and Future Risks are taken into Account in the Remuneration Process

Key Measures used to take account of key risks

Key measures used to take account of the above risks are:

How key measures affect remuneration

Compensation risks are mitigated through the Company’s risk management strategies that capture, monitor and control risks created through business activities. A balance of long term and short term metrics and multiple levels of performance measurement are used to determine employee compensation. There has been no change in these performance measures over the past year.

- Key Risks

Due to the Company’s small size and the uncomplicated nature of its business, current and future risks regarding remuneration are low. Key compensation risks taken into account when implementing remuneration measures are: - Employees not being paid in a timely manner leading to dissatisfaction and/or reputational damage;

- Salaries that are too high resulting in a strain on the Company’s profitability;

- Salaries that are too low leaving the Company unable to keep or attract employees of a high standard; and

- Performance incentives/ compensation structures that lead employees to act in a manner inconsistent with ethical standards, prudent business practices and the Company’s operational strategies.

Key measures used to take account of the above risks are:

- Supply and demand of labour and the needs of the Company;

- Industry standards;

- Employee performance (relative and absolute) and new skills acquired;

- Employee qualification, experience and job description;

- Financial performance – current revenue and growth; long-term revenue projections; expense management; capital and liquidity management.

- Risk and control management – employee understanding of risky behaviour; protection of the Company’s reputation; maintenance of compliance and controls.

Compensation risks are mitigated through the Company’s risk management strategies that capture, monitor and control risks created through business activities. A balance of long term and short term metrics and multiple levels of performance measurement are used to determine employee compensation. There has been no change in these performance measures over the past year.

Linking Performance with Levels of Remuneration

Main performance metrics

The Company uses multiple performance measures to determine employee remuneration. The main performance metrics are:

Achievement of Company, department and individual targets

Completion of certain projects/objectives;

Initiative;

Teamwork;

Fulfillment of job description; and

Relative and absolute performance.

How individual remuneration is linked to Company-wide and individual performance

There is a direct, positive link between remuneration and bank-wide and individual performance. A strong performance results in increased compensation and a weak performance results in no increase or a lower compensation. Weak performance metrics include poor performance, significant risk-related issues and inappropriate behaviour. In the event of weak individual performance, salary would be held without further raises or bonuses given until performance improved to an acceptable level. In the event of poor Company performance, the option of unpaid leave would be given to certain staff (i.e. the weakest performers) until Company performance improved.

Adjusting remuneration to take account of longer-term performance

The Human Resources and Compensation Policy ensures that compensation for senior management is focused on achieving long-term business objectives. Stock options may be granted to employees and are at the management’s discretion. There is a finite date for exercising stock options granted to employees (usually two (2) weeks after the option date). Claw back arrangements are not a part of the Company’s current compensation practices. Adjusted deferred remuneration is not a part of the Company’s current compensation practices.

The Company uses multiple performance measures to determine employee remuneration. The main performance metrics are:

There is a direct, positive link between remuneration and bank-wide and individual performance. A strong performance results in increased compensation and a weak performance results in no increase or a lower compensation. Weak performance metrics include poor performance, significant risk-related issues and inappropriate behaviour. In the event of weak individual performance, salary would be held without further raises or bonuses given until performance improved to an acceptable level. In the event of poor Company performance, the option of unpaid leave would be given to certain staff (i.e. the weakest performers) until Company performance improved.

The Human Resources and Compensation Policy ensures that compensation for senior management is focused on achieving long-term business objectives. Stock options may be granted to employees and are at the management’s discretion. There is a finite date for exercising stock options granted to employees (usually two (2) weeks after the option date). Claw back arrangements are not a part of the Company’s current compensation practices. Adjusted deferred remuneration is not a part of the Company’s current compensation practices.

Variable Remuneration

Forms of variable remuneration

Variable compensation is not part of current employment contracts, it is a discretionary decision made by management through granting of stock options and/or cash bonuses. The amount of variable compensation is determined through careful review of the Company’s short term revenue and profit, long term revenue and profit projections, risk evaluation and employee performance. Stock options are granted to senior management only, while cash bonuses may be granted to all employees after evaluation of financial and non-financial measures. Non-financial measures considered include:

Employee role within the Company;

Company culture;

The effect on the Company’s well-being and financial condition; and

Employee motivation.

Variable compensation is not part of current employment contracts, it is a discretionary decision made by management through granting of stock options and/or cash bonuses. The amount of variable compensation is determined through careful review of the Company’s short term revenue and profit, long term revenue and profit projections, risk evaluation and employee performance. Stock options are granted to senior management only, while cash bonuses may be granted to all employees after evaluation of financial and non-financial measures. Non-financial measures considered include:

Quantitative Disclosures

Number of Meetings

The Board Risk Oversight Committee holds, at minimum, four (4) meetings during the financial year. Each director of the Company is entitled to receive remuneration at the rate of $10,000 per annum plus an additional $2,500 per annum if the director sits on one or more committees. A director may elect to receive the remuneration in cash payable, in share options of the Company, or in Legacy Equity and Participation Units (“LEAP Units”) the economic burden of which falls on the shareholder. During the 2021 financial year, all directors elected to receive remuneration in the form of LEAP units.

The Management Risk Management Committee holds, at minimum, four (4) meetings during the financial year. No extra remuneration is paid to its members.

Variable remuneration awards

Some employees received variable remuneration awards during the financial year.

Guaranteed bonuses

No employee received a guaranteed bonus during the financial year.

Sign-on awards

No employee received a sign-on award during the financial year.

Severance Payments

No employee received a severance payment during the financial year.

Deferred remuneration

The Company did not issue any outstanding deferred remuneration during the financial year. There was no deferred remuneration paid out during the financial year.

Breakdown of amount of remuneration awards

All remuneration paid during the financial year was 100% fixed cash-based remuneration.

Employee exposure to implicit and explicit adjustments of deferred and retained remuneration

The Company does not have any deferred or retained remuneration exposed to ex post explicit and/or implicit adjustments.

The Board Risk Oversight Committee holds, at minimum, four (4) meetings during the financial year. Each director of the Company is entitled to receive remuneration at the rate of $10,000 per annum plus an additional $2,500 per annum if the director sits on one or more committees. A director may elect to receive the remuneration in cash payable, in share options of the Company, or in Legacy Equity and Participation Units (“LEAP Units”) the economic burden of which falls on the shareholder. During the 2021 financial year, all directors elected to receive remuneration in the form of LEAP units.

The Management Risk Management Committee holds, at minimum, four (4) meetings during the financial year. No extra remuneration is paid to its members.

Some employees received variable remuneration awards during the financial year.

No employee received a guaranteed bonus during the financial year.

No employee received a sign-on award during the financial year.

No employee received a severance payment during the financial year.

The Company did not issue any outstanding deferred remuneration during the financial year. There was no deferred remuneration paid out during the financial year.

All remuneration paid during the financial year was 100% fixed cash-based remuneration.

The Company does not have any deferred or retained remuneration exposed to ex post explicit and/or implicit adjustments.